US Tariffs Push Tiruppur’s Knitwear Industry to the Brink: Exporters Call for Immediate Relief

The Tiruppur knitwear cluster,

India’s largest apparel hub, is staring at one of its toughest crises as the

recent US tariff hike threatens to erode export competitiveness. Tiruppur

accounts for nearly 68% of India’s knitwear exports, recording ₹44,747 crore in

FY25, up 16.5% from the previous year. The United States absorbs close to 40%

of these shipments, translating into monthly exports of ₹1,500-2,000 crore. The

new tariff regime has placed this flow at risk, forcing exporters into a

scramble to salvage orders and protect livelihoods.

Exporters report that American

buyers are demanding discounts of up to 25% to compensate for higher landed

costs. Nearly ₹4,500 crore worth of goods are stuck in the pipeline, with

potential direct losses of ₹1,100-1,200 crore if the tariff burden falls on

exporters. Liquidity is tightening as banks turn cautious on US-linked lending,

raising concerns of defaults and production halts.

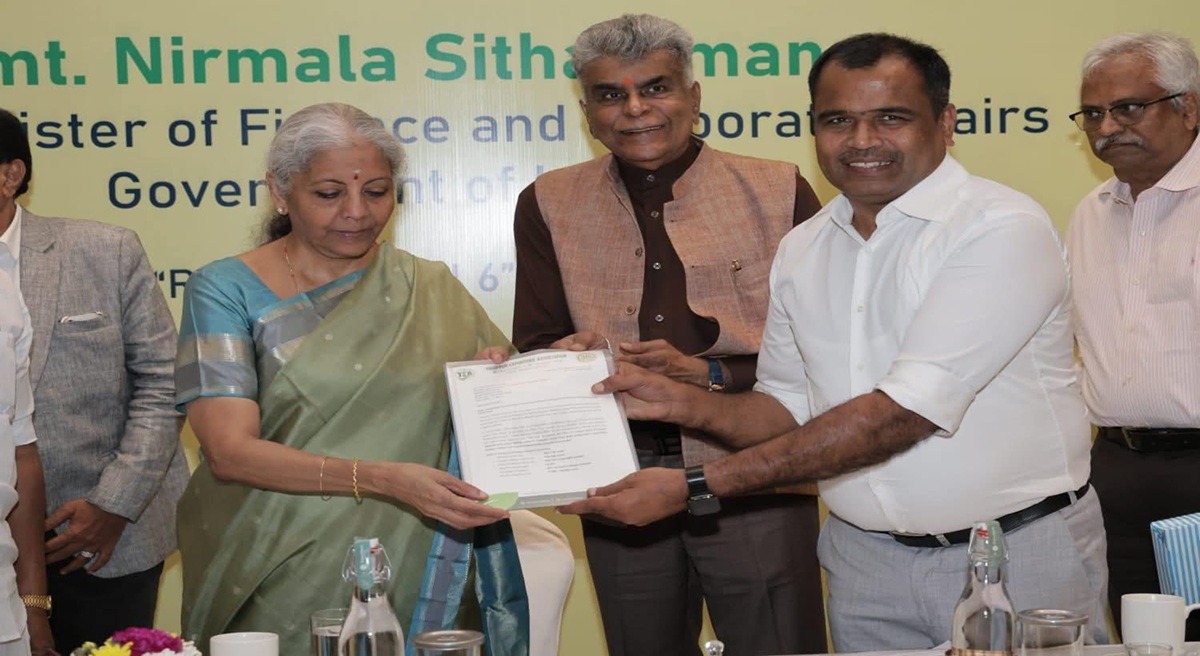

The Tiruppur Exporters’ Association

has sought urgent government intervention, including an extension of NPA

recognition from 90 to 180 days, a two-year moratorium on term loans, an

emergency credit line, and continuation of the Interest Equalization Scheme

without the current ₹50 lakh cap. The industry has also requested a one-year

holiday on PF and ESI contributions to safeguard more than one million jobs,

65% of which belong to women from rural areas.

The crisis comes at a time when

global competitors like Vietnam and Bangladesh are consolidating their

advantages through preferential trade agreements and lower costs. Bangladesh,

under its duty-free access to the US and EU markets, continues to attract large

orders, while Vietnam benefits from robust supply chain linkages and FTAs with

major economies. India risks losing market share rapidly if support measures

are not deployed swiftly.

In the longer term, stakeholders

argue that India must diversify export markets, invest in free trade

agreements, and build resilience through product innovation and supply chain

digitization. Without such measures, tariff shocks and policy gaps could derail

India’s ambition to reach USD 100 billion in textile and apparel exports by the

end of the decade.

The Tiruppur story reflects the

wider fragility of India’s export ecosystem. Unless the government responds

with urgent relief and strategic trade policy, the country could face not just

a dip in exports but a severe employment and social crisis in one of its most

labour-intensive industries.

The Tiruppur Exporters’ Association has sought urgent government intervention, including an extension of NPA recognition from 90 to 180 days, a two-year moratorium on term loans, an emergency credit line, and continuation of the Interest Equalization Scheme without the current ₹50 lakh cap.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.