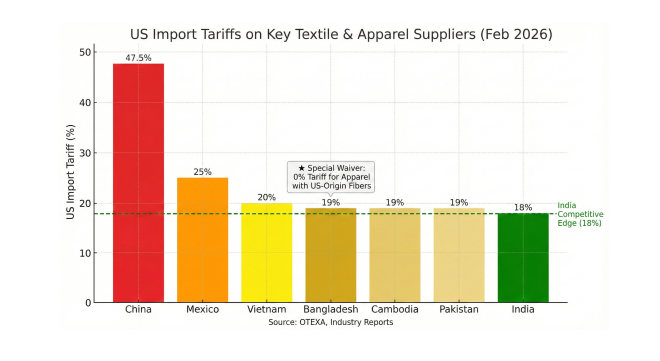

Impact Of Lower US Tariff On India’s Competitors In Textile & Apparel Trade

The revised US tariff regime continues to reshape sourcing

dynamics across the global textile and apparel supply chain. India’s duty is

estimated at 18%, while competing suppliers face varied rates: China above 34%,

Vietnam at about 20%, Bangladesh now at 19% with fibre-linked duty waivers,

Mexico around 25%, and Pakistan and Cambodia near 19%. These differences

directly influence landed costs for US buyers, especially in price-sensitive

categories, and are already reflected in the export trajectories of major

suppliers over the last five years.

China (Tariff: 34%+)

China remains the largest textile and apparel supplier to

the US but has seen a pronounced decline after its 2022 peak. Imports from

China rose from about US$25.3 billion in 2020 to nearly US$32.7 billion in

2022, before dropping sharply to roughly US$18.2 billion by 2025 (till

November). The contraction reflects tariff pressures, geopolitical risks, and

sustained brand diversification strategies. China’s exports remain diversified

across synthetic apparel, outerwear, knit tops, home textiles, and technical

fabrics, but the structural downtrend indicates reduced reliance by US buyers.

Vietnam (Tariff: ~20%)

Vietnam has been the principal beneficiary of China-plus-one

strategies. Exports increased from about US$13.4 billion in 2020 to US$19.7

billion in 2022, before moderating to around US$14.7 billion in 2025 (till

Nov). Vietnam’s strength lies in man-made fibre apparel, sportswear, outerwear,

and performance garments, supported by integrated supply chains and strong

FDI-driven manufacturing clusters. The recent plateau suggests demand

normalization and intensified competition as tariff advantages narrow.

Bangladesh (Tariff: 19% with Fibre-Linked Waiver)

Bangladesh’s tariff has been revised from 20% to 19%, with a

major incentive: garments made using US-origin cotton or synthetic fibres now

enter duty-free under the reciprocal structure. This provision creates a

targeted cost advantage in fibre-linked supply chains. Over the last five

years, Bangladesh’s exports to the US rose from about US$5.4 billion in 2020 to

US$10.0 billion in 2022, before easing to roughly US$7.5 billion in 2025 (till

Nov). The country’s core strength remains in cotton trousers, basic knitwear,

and woven shirts. The new arrangement is expected to shift raw material

sourcing toward US fibres and enhance Bangladesh’s competitiveness in

large-volume, price-sensitive categories.

Mexico (Tariff: ~25%)

Mexico’s exports have remained relatively stable but without

strong expansion. Shipments increased from about US$3.2 billion in 2020 to

US$5.0 billion in 2023, before easing to roughly US$4.7 billion in 2025 (till

Nov). Mexico’s primary advantage is geographic proximity, enabling fast

replenishment cycles in denim, knit tops, and workwear under regional trade

frameworks. However, higher labour costs and limited capacity expansion have

constrained significant growth.

Cambodia (Tariff: ~19%)

Cambodia has shown gradual expansion in select segments.

Exports to the US increased from roughly US$3.3 billion in 2020 to about US$4.7

billion in 2025 (till Nov). The country is concentrated in cut-and-sew

knitwear, casualwear, and basic garments for value-focused retailers. Its

growth reflects continued buyer interest in low-cost sourcing destinations,

though overall scale remains smaller than leading Asian suppliers.

Pakistan (Tariff: ~19%)

Pakistan’s exports have followed a moderate but somewhat

volatile trajectory. Shipments rose from about US$3.4 billion in 2020 to around

US$5.3 billion in 2022, before stabilizing near US$4.2–4.5 billion in recent

years. Pakistan’s competitive edge lies in cotton-based categories,

particularly denim, home textiles, towels, and bed linen, supported by a strong

upstream spinning and weaving base. However, energy costs and macroeconomic

pressures have limited faster expansion.

Conclusion

Over the last five years, China has seen the sharpest

contraction after peaking in 2022, while Vietnam and Bangladesh experienced

growth followed by stabilization. Mexico, Cambodia, and Pakistan have moved

within narrower export bands, relying on niche strengths or geographic

advantages. The updated tariff alignment—India at 18%, Bangladesh at 19% with

fibre-linked duty-free access, and others between 19% and 34%+—creates new

competitive equations. Bangladesh’s fibre-based waiver could strengthen its position

in US-linked supply chains, particularly for cotton and synthetic apparel. At

the same time, India’s lower baseline duty still offers a broad-based cost

advantage across categories.

As brands optimise sourcing against duty structures,

compliance requirements, and supply chain resilience, order flows are likely to

shift toward suppliers that combine tariff competitiveness with scale,

reliability, and diversified product capabilities.

Over the last five years, China has seen the sharpest contraction after peaking in 2022, while Vietnam and Bangladesh experienced growth followed by stabilization. Mexico, Cambodia, and Pakistan have moved within narrower export bands, relying on niche strengths or geographic advantages. The updated tariff alignment—India at 18%, Bangladesh at 19% with fibre-linked duty-free access, and others between 19% and 34%+—creates new competitive equations. Bangladesh’s fibre-based waiver could strengthen its position in US-linked supply chains, particularly for cotton and synthetic apparel. At the same time, India’s lower baseline duty still offers a broad-based cost advantage across categories.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.